“And it forced me to realize the partnership between pride and cash and you will money early on the. I just advised me personally, Well, you know what? I am here discover a qualification. So, let’s manage that which we must do to really make it happen.”

Throughout their particular first slide semester away from school, she told you, she got a first jobs lower than their unique gear. Because of the springtime session, she know she might take on a second occupations as well to store settling their obligations.

Sooner or later, she has worked about three jobs during for every single semester from college as the she grabbed aside this new financing to pay for their college will cost you.

To have their own sophomore, junior and you can old-age of university, she spent some time working because the a resident assistant, including stored several almost every other campus efforts, she told Fox Information Electronic.

Way too many people or even school graduates, in her see, are “distress in silence” because they try to lower the student loans or any other financial obligation.

In the act, she together with discovered how their own funds amassed focus and you may realized that their colleagues just weren’t learning as much as she involved the newest economic the inner workings off paying for university.

“You just need to know what your problem was” and never proper care too-much regarding others’ circumstances or positions, she said.

Taking at ease with amounts

It-all generated her much more computed to expend off her finance because the steadily and you will rapidly while the she you certainly will, in order to ensure it is their, she extra, once she finished regarding university in 2011, to visit scholar college too.

Micah mentioned that too many pupils otherwise university graduates, inside her examine, was “distress in silence” as they make an effort to reduce their college loans.

As a consequence of a dialogue which have a buddy on the student loan cost, Micah pointed out that if she made most payments every month, she might have their particular loan full repaid prior to when she think.

Subsequently, she told you, “lifetime has essentially removed from” getting their own. She and her partner had hitched inside the pandemic – “We had the ceremony in our garden,” she told you – and from now on loans Leeds AL they might be expecting.

“Your way of obtaining paid my figuratively speaking,” she said, “educated myself tips finances, just how to rescue, how to invest, and i imagine the foundation gave me knowledge forever.”

As an alternate resident sufficient reason for a child on the road, Micah common suggestions for other people who need certainly to reach financial independence.

step 1. Rating at ease with numbers. “I think you should speak wide variety,” she told you. “Inside checking regarding my personal beginner loans, members of the family began talking-to myself about their credit card debt.” You to, in turn, lead to an increased feel and knowledge to their area, she said, out of how exactly to lower the loans.

dos. Understand the mortgage processes. “What they try not to inform you,” said Micah, referring to taking out fully college loans, “is the fact that the time your sign that notice, this is the day you to attention initiate meeting.”

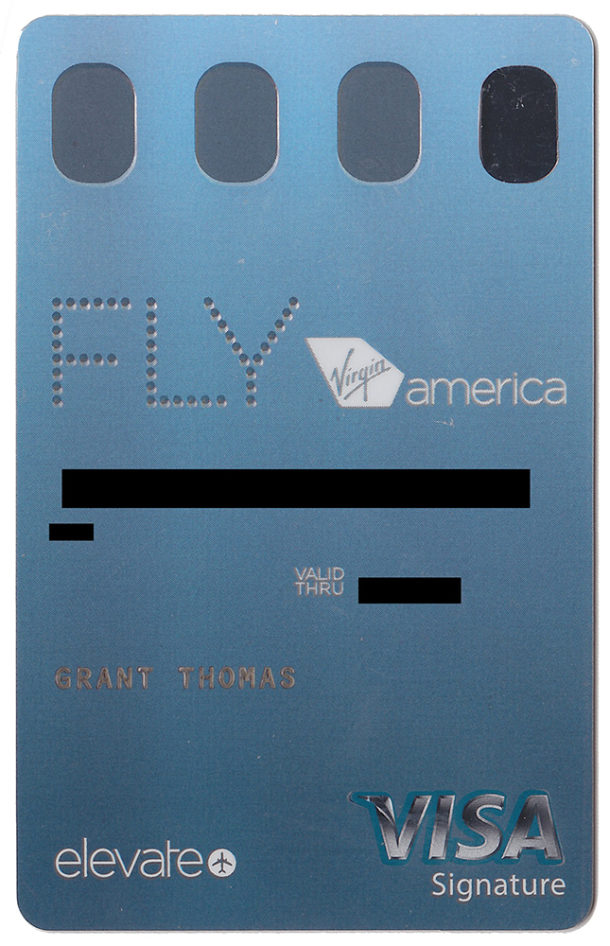

Sooner, she ended up refinancing which have SoFi – cutting their own financing identity by 50 percent and saving step 3%-4% from inside the notice, she told you

step 3. Cut costs. “I common a business flat which have someone to slice can cost you,” she said, referencing their own scholar university ages and you may past. “I wandered to get results and brownish-bagged they.”

She additional, “I did so travelling. And though I would personally has actually lived-in hostels, We have men and women press back at my passport.”

cuatro. Learn your really worth. Micah said it absolutely was of the dealing with SoFi’s free of charge job coach you to she involved learn their particular bargaining power, together with simple tips to discuss to possess an income improve whenever she altered services.